Capitalism—A Propaganda Story

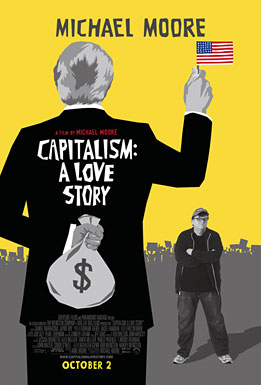

Michael Moore is the Leni Riefenstahl of our time. Or, perhaps he would be better characterized as a Bizzaro World Leni Riefenstahl, because while she propped up with propaganda the political powers of her time, Moore uses the same techniques to bring down the powers of our time, be it GM (Roger and Me), the gun lobby (Bowling for Columbine), the government (Fahrenheit 911), the health care industry (Sicko), or free enterprise (Capitalism: A Love Story).

In this latest installment in his continuing series of what’s wrong with America, Michael Moore takes aim at his biggest target to date, and the result is a disaster. The documentary is not nearly as funny as his previous films, the music selections seem contrived and flat, and the edits and transitions are clumsy, wooden, and not nearly as effective as what we’ve come to expect from the premiere documentarian (Ken Burns notwithstanding) of our time. And, most importantly, the film’s central thesis is so bad that it’s not even wrong.

First, let me confess that even though I have disagreed with most of Michael Moore’s politics and economics throughout his career, I have thoroughly enjoyed his films as skilled and effective works of art and propaganda, never failing to laugh — or be emotionally distraught — at all the places audiences are cued to do so. My willing suspension of disbelief that enables me to take so much pleasure from works of fiction, does not always serve me well when pulled into the narrative arc of a documentary. Thus it is that with his past films I have exited the theater infuriated at the same things Moore is … until I rolled up my sleeves and did some fact checking of my own, at which point Moore’s theses unravel (with the possible exception of Bowling for Columbine, his finest work in my opinion). But with Capitalism: A Love Story, Moore’s propagandistic props are so transparent and contrived that I never was able to suspend disbelief.

What was especially infuriating about Capitalism: A Love Story was the treatment of the people at the bottom end of the economic spectrum. The film is anchored on two eviction stories contrived to pull at the heart strings. One family filmed the eviction process themselves and sent the footage to Moore in hopes he’d use it (many are called, few are chosen), and the other was filmed by Moore’s crew. The message of both is delivered with a sledge hammer: Greedy Evil Soul-Sucking Bankers (think Lionel Barrymore’s villainous Mr. Potter in It’s a Wonderful Life) are tossing out onto the streets of America poor innocent families who are victims of circumstances not of their making. Why? First, because this is what Greedy Evil Soul-Sucking Bankers do for fun on weekends. Two, because the economic crisis caused solely by said bankers has made it impossible for families to make the payments on those subprime loans they were tricked into taking by those same bankers, who themselves were suckered into a Ponzi-like scheme cooked up by Alan Greenspan and his Wall Street/Federal Reserve buddies to take back the homes fully owned by (first) the elderly and (then) the poor. In the fine print that the bankers carefully slipped past the elderly and the poor for these second mortgages and subprime loans, the contracts said that the rates on variable rate loans could go up, and that the house was collateral for the loan such that if the loan payments are not made the home is subject to foreclosure and repossession by the bank (which is what the bankers are hoping happens).

In Michael Moore’s worldview, a goodly portion of the American people are ignorant, uneducated, clueless pinheads too stupid to realize the fundamental principle of a loan: you have to have collateral to secure the loan! No collateral, no loan. You say to the banker “I would like to take out a loan.” The banker says to you “what do you have for collateral?” What happened in the housing boom was that bankers relaxed their standards for what they would require for collateral (and income, assets, etc.) because (1) the government told them to do so and promised to cover their losses if it didn’t work out, and (2) they wanted to make more money; and borrowers wanted in on the cash cow that everyone was milking, from individual house flippers looking for a quick buck, to ordinary families wanting extra cash for remodeling, tuition, or whatever, to mortgage giants wanting corporate expansion. And all were driven by the same motive: greed!

Yes, greed. Those evicted families knew perfectly well what they were doing when they freely chose to climb onto the housing bubble and take it for a ride. I have a much higher view of the American public than does Michael Moore. I don’t think the American people are so stupid or uneducated that they didn’t know what they were doing. This wasn’t rocket science. It was even on television, the ne plus ultra of pop culture! I well remember watching A & E’s television series Flip This House, and reading all those magazine articles and get-rich-quick books on how to make a fortune in the real estate market, and thinking “wow, everyone’s getting rich except me; how can I get in on the action?”

What I felt is, I’m sure, what lots of people felt. I looked into securing a second mortgage on my home in order to build a second home on an undeveloped portion of my hillside property, and then selling it to turn a tidy profit. Everyone was doing it. What could go wrong? Well, for starters I thought, what if it takes longer to build the home than I projected? We all know how slow construction projects can be. Could I make the payments on the second mortgage for an additional six months to a year? And what if I couldn’t sell that second home? Could I make the payments on the new loan indefinitely? What if my income decreased instead of increased, like it was at the time (and, subsequently, did … dramatically!). And what would happen if I couldn’t make the payments? The answer was obvious, and it wasn’t in the fine print: I could lose my primary home.

Forget that! Making a profit on a second home would be nice, but losing my first home would hurt well more than twice as much as making a profit on the second home would feel good. That’s a basic principle of risk aversion: losses hurt twice as much as gains feel good. Now, I’m not really a risk-averse guy (I gave up a secure career as a college professor for an insecure career as a writer and publisher), but even I could see the inherent risks involved when the home you live in could be taken away. My hillside remains sagebrush and wild grass.

What about the people on the other end of the economic spectrum — the bankers and Wall Street moguls? Why aren’t they being evicted. Now, given that I’m a libertarian, you might expect me to come to the defense of Corporate America. Not so. Here I am in complete agreement with Michael Moore that, as I’ve been saying since the day it was first pronounced, “too big to fail” is the great myth of our time. None of these giant corporations — GM, AIG, Bank of America, Goldman Sachs, et al. — should have been bailed out. In fact, they should have been allowed to fail, their stocks go into the toilet, their employees tossed out on to the gilded streets of lower Manhattan, and their CEOs dispersed to work as greeting clerks at Walmart. They gambled and lost on all those securities, bundled securities, derivatives, credit default swaps, and other “financial tools” that I’ll bet not one in a hundred Wall Street experts actually understands. If you really believe in free enterprise, you must accept the freedom to lose everything on such gambles. These CEOs and their corporate lackeys are nothing more than welfare queens who adhere to the motto “in profits we’re capitalists, in losses we’re socialists.” Sorry guys, you can’t have it both ways without corrupting your morals, which you have, along with the politicians you’ve bribed, cajoled and otherwise coerced to your bidding.

The solution? I have some suggestions of my own, but Michael Moore’s solution is beyond bizarre: replace capitalism with democracy. Uh? Replace an economic system with a political system? Even the über liberal Bill Maher was baffled by that one when he hosted Moore on his HBO show. How does a democracy produce automobiles and computers and search engines? It doesn’t. It can’t.

Capitalism: A Love Story, ends with a remarkable film clip that Moore discovered of President Franklin Roosevelt reading from his never proposed second Bill of Rights (he died shortly after and the document died with him). Included in the list are:

- The right to a useful and remunerative job in the industries or shops or farms or mines of the nation;

- The right to earn enough to provide adequate food and clothing and recreation;

- The right of every farmer to raise and sell his products at a return which will give him and his family a decent living;

- The right of every businessman, large and small, to trade in an atmosphere of freedom from unfair competition and domination by monopolies at home or abroad;

- The right of every family to a decent home;

- The right to adequate medical care and the opportunity to achieve and enjoy good health;

- The right to adequate protection from the economic fears of old age, sickness, accident, and unemployment;

- The right to a good education.

That’s nice. To this list I would add a computer in every home with wireless Internet access. I’m sure we could all think of many more things “under which a new basis of security and prosperity can be established for all — regardless of station, race, or creed,” in Roosevelt’s words. But there is one question left unstated: Who is going to pay for it? If there is no capitalism, from where will the wealth be generated to pay for all these wonderful things? How much does a “decent” home costs these days, anyway?

Do you see the inherent contradiction? Of course you do. So does Michael Moore, who elsewhere in the film longs for the good old days when the “rich” were taxed 90% of their earnings. So did Willie Sutton, who answered a similar question after being nabbed by the FBI during the Great Depression and asked by a reporter why he robs banks: “Because that’s where the money is.”

• FOLLOW MICHAEL SHERMER ON TWITTER •