How the survivor bias distorts reality

When I purchased my latest vehicle, I was astonished to get the license plate 6NWL485. What are the chances that I would get that particular configuration? Before I received it, the odds would have been one in 175,760,000. (The total number of letters to the power of the number of letters on the plate times the total number of digits to the power of the number of digits on the plate: 263 x 104). After the fact, however, the probability is one.

This is what Pomona College economist Gary Smith calls the “survivor bias,” which he highlights as one of many statistically related cognitive biases in his deeply insightful book Standard Deviations (Overlook, 2014). Smith illustrates the effect with a playing card hand of three of clubs, eights of clubs, eight of diamonds, queen of hearts and ace of spades. The odds of that particular configuration are about three million to one, but Smith says, “After I look at the cards, the probability of having these five cards is 1, not 1 in 3 million.” (continue reading…)

read or write comments (6)

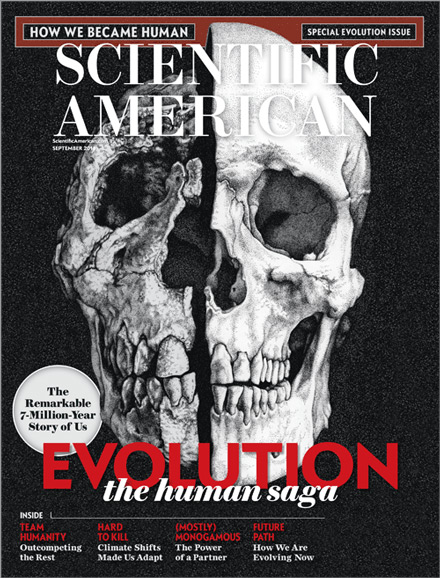

Evolution helps us imagine what aliens might be like

What are the odds that intelligent, technically advanced aliens would look anything like the ones in films, with an emaciated torso and limbs, spindly fingers and a bulbous, bald head with large, almond-shaped eyes? What are the odds that they would even be humanoid? In this YouTube video, produced by Josh Timonen of the Richard Dawkins Foundation for Reason and Science, I argue that the chances are close to zero. Richard Dawkins himself made this interesting observation in a private communication after viewing it:

I would agree with [Shermer] in betting against aliens being bipedal primates, and I think the point is worth making, but I think he greatly overestimates the odds against. [University of Cambridge paleontologist] Simon Conway Morris, whose authority is not to be dismissed, thinks it positively likely that aliens would be, in effect, bipedal primates. [Harvard University biologist] Ed Wilson gave at least some time to the speculation that, if it had not been for the end-Cretaceous catastrophe, dinosaurs might have produced something like the attached [referring to paleontologist Dale A. Russell’s illustrated evolutionary projection of how a bipedal dinosaur might have evolved into a reptilian humanoid].

(continue reading…)

read or write comments (5)